Cargo insurance provides coverage against physical loss or damage to goods during transport to and from Qatar. It safeguards against a range of incidents, including airplane crashes, accidents, fires, theft, and natural disasters. This insurance protects against financial losses incurred from such damages, sparing you from the cost of repairing or replacing expensive items.

Cargo insurance is particularly crucial for overseas shipments compared to domestic ones due to the complex nature of international shipping laws and regulations. In Qatar, like in many countries, these regulations can vary significantly and affect the liability and coverage needed for shipments entering or leaving the country. If you're transporting high-value or fragile items, having cargo insurance is essential as it allows you to recover associated costs in case of damage or loss.

The cost of cargo insurance varies based on factors such as the type of cargo, mode of transportation, cargo value, and shipping distance. Businesses in Qatar need to ensure they have proper cargo insurance to protect against potential financial losses resulting from transit incidents.

What is Cargo insurance in Qatar?

Cargo insurance is essential in Qatar and globally, offering coverage that protects the value of goods from physical damage, theft, or general wear and tear during transit. This insurance assures by safeguarding shipments against loss, damage, or theft.

In Qatar, as in other countries, cargo insurance plays a crucial role in mitigating financial losses. It reimburses the insured amount in the event of covered incidents such as damage or theft, thereby helping businesses recover from potential setbacks.

The cost of cargo insurance in Qatar varies depending on factors such as the type of cargo, mode of transportation, cargo value, and shipping distance. Businesses must carefully evaluate the cost of insurance against potential losses and collateral damage that could occur without adequate coverage.

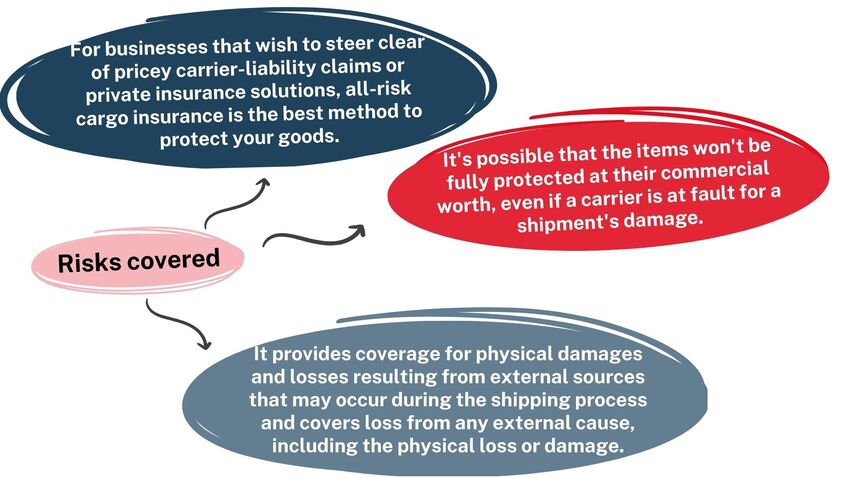

Risks covered

Cargo insurance, a form of marine insurance, provides coverage for the loss or damage of goods transported via sea, land, or air. It safeguards against a spectrum of risks during shipment, including theft, loss, damage, delay, and destruction. Key risks covered include loss or theft by external parties, damage from accidents or natural disasters, and delays due to unforeseen events. Additionally, cargo insurance covers legal costs associated with disputes that may arise during transportation.

- For businesses seeking to avoid costly carrier liability claims or relying solely on private insurance solutions, all-risk cargo insurance is recommended for comprehensive protection of goods.

- This type of insurance ensures coverage for physical losses and damages caused by external sources throughout the shipping process.

Benefits of Cargo Insurance

Cargo coverage offers invaluable benefits to business owners, serving as a crucial tool for safeguarding shipments and providing peace of mind:

- Business Advantage: Cargo insurance is indispensable for protecting shipments, ensuring both financial security and peace of mind. With the right coverage, businesses in Qatar can rest assured that their goods will arrive at their destination intact and in excellent condition.

- Financial Security: Cargo insurance provides essential financial protection in case of incidents during transportation in Qatar. It covers losses or damages, helping businesses recover from any financial setbacks associated with their cargo.

- Peace of Mind: For business owners in Qatar, having cargo coverage in place reduces the stress of product delivery. It ensures that cargo is safeguarded, allowing for smoother operations and assured delivery.

On the whole, cargo coverage is an essential asset for any business owner, offering comprehensive protection for shipments and peace of mind in both financial and operational aspects.

Who Needs Cargo Insurance?

E-COMMERCE OWNERS

Protecting customer shipments from potential losses and disputes.

CONSUMERS

Ensuring protection when sending valuable items like jewelry or during relocations.

COMPANIES

Safeguarding goods during international shipments against various transportation risks.

How to Choose the Right Cargo Insurance?

Selecting appropriate cargo insurance is critical for business success in Qatar and involves considering the following factors:

- Coverage Needs: Choose a cargo insurance plan that specifically covers the types of goods regularly transported to and from Qatar. This ensures comprehensive protection tailored to local shipping requirements.

- Cargo Value: Assess the value of goods being shipped to determine the appropriate level of insurance coverage. In Qatar, where goods may include high-value items such as electronics or luxury goods, adequate protection is crucial to mitigate financial risks.

- Insurer Reputation: Research the track record and financial stability of insurers offering cargo insurance in Qatar. This ensures reliability in claim settlements and peace of mind for businesses relying on insurance coverage.

- Deductibles: Understand the deductibles specified in cargo insurance policies. Balancing cost savings with financial responsibility in claims is essential for businesses operating in Qatar's dynamic market.

- Policy Validity: Ensure that the cargo insurance policy remains current and aligns with the coverage needs of shipments originating from or destined for Qatar. Regularly review policy terms to avoid gaps in coverage, especially considering policy expiration dates.

By following these guidelines tailored to Qatar's business environment, businesses can effectively select cargo insurance that meets their operational requirements and provides comprehensive protection for their shipments.

FAQ | Cargo Insurance in Qatar

What types of cargo does your insurance cover?

Our cargo insurance covers a diverse range of goods including electronics, furniture, machinery, medical equipment, and other valuable items. We ensure comprehensive protection tailored to various shipment needs.

How does your cargo insurance benefit businesses in Qatar?

Our cargo insurance in Qatar provides crucial protection against risks such as theft, damage, or loss during transit. It helps businesses mitigate financial losses and ensures peace of mind throughout the shipping process.

What factors influence the cost of cargo insurance with your company?

The cost of cargo insurance depends on factors such as the type of cargo, mode of transportation, cargo value, shipping distance, and our assessment of risk. We offer competitive pricing while maintaining high standards of coverage.

How can businesses in Qatar customize their cargo insurance policy with your services?

Businesses in Qatar can tailor their cargo insurance policy to meet specific needs, including coverage limits, deductible options, and additional protections for high-value or fragile shipments. Our flexible policies ensure comprehensive protection.

What distinguishes your all-risk cargo insurance from other coverage options?

Our all-risk cargo insurance offers extensive coverage against a wide range of risks during transportation. It includes protection for unforeseen events that may occur in Qatar or during international shipments.

Is cargo insurance mandatory for businesses in Qatar?

While cargo insurance is not legally required in Qatar, it is highly recommended for businesses involved in international trade or transporting valuable goods. It serves as a proactive measure to safeguard against financial risks associated with shipping.

DocShipper | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!