Welcome To DocShipper

Customs Port Law’s & Compliance When Importing To Qatar

Alert: This page targets only customs duties and taxes practiced within Qatar's borders.

Introduction

When it comes to the importing and exporting process, keep in mind that local customs and port regulations are implemented, and covers all factors related to any shipped product, in and out of Qatar's main ports. Customers that want to practice freight forwarding should abide by the regulations issued to them in accordance by the local and national custom officials, and should also not neglect the responsible country officials controlling the import and export of goods in accordance & in a legal manner.

1) How Can DocShipper Help You Clear Your Goods At Customs

Nowadays, the world market is rapidly changing its manufacturing needs, and shipping calendars have intensified resulting in a larger amount of work on the customs duty brokers, a need to deliver customized services for the procedure of Customs clearance is vital to avoid delays and provide a swift service. Docshipper is one of the main businesses that offers customs brokerage services in Qatar. We are capable of processing all kinds of legal cargo shipments from containers to

Furthermore, DocShipper can also be counted on for your deliveries from or to the airport/land customs (Abu Samra)/Qatar borders. We have a strong reputation for being a major customs broker operating in Qatar as well as in the Middle East. Our logistics group also maintains strong ongoing professional connections between the Qatari government and other agencies and its special position as a preferred company provides a definite competitive edge in the management of complex and challenging shipments in addition to our rigidity of administrative formalities for the Middle East.

Importer’s Guidelines In State Of Qatar

The Qatari government implemented strict rules concerning cosmetic products, electronics, cologne automotive spare parts and toys, those rules and regulations have been set through the ministry of business and trade, consumer protection section and QGOSM Qatar General Organization for Standardization As stated by the government regulations, " Qatar's customs office would not allow restricted goods to be imported without evidence that they comply with the Qatari customs regulations, including compliance certificates, inspection records, from an authorized entity of the supplying national state ". In the event of failure to comply with the requirements of the Qatar and Gulf Standards Organization (GSO), it would be prohibited to access Qatar, according to the terms of the memorandum. Certificates of compliance delivered through DocShipper to ship legal products are accepted by QGOSM/Qatar at customs clearance of such shipments upon arrival on Qatar's land.

It is a legal obligation for all importers to possess an import permit. Importation certificates will only be issued to the locals in Qatar or shareholder in a private company. Such permits should be recorded from the Ministerial department of Finance & Commerce. This also goes for all foreign-invested firms doing business in Qatar; nevertheless, non domestic enterprises in Qatar are required to local counterparts. The import of meats, for example ox and poultry-based foods, is subject to a hygiene and health attestation from nation that exports this product as well as a "halal" stamping attestation provided on request by an authorized Islamic institute in the exporting destination. For customs clearance in Qatar of products during this phase, people that import them should include legal records regarding a informative custom clearance documents to present:

-

Bill of lading

-

Import permit

-

Pro forma invoice

-

Certificate of origin

DocsShipper Advice: Did you know? DocShipper Qatar can save you time by handling everything, including customs clearance. If you want to save time or are having difficulties with the specified standards, feel free to contact us and ask for a free quote.

Qatar's major Import products are classified as follows under the International Trade Centre (ITC):

- Gas Turbines

- Jewellery

- Cars

- Planes

- Helicopters

- Spacecraft

- Broadcasting Equipment

Customs Clearance

There are strict laws in Qatar which should be followed to ensure the customs clearance of the merchandise. As a result, it is necessary to ensure that all goods are registered using a customs entry form together with a manifold submitted on arrival at the customs office. After being physically examined, in the event that a difference is discovered in relation to the merchandise , extra duties as well as a penalty may be imposed. Infringement of customs regulations can lead to late arrivals, fines, warehouse/clearing fees and the recovery of the merchandise at the point of origin. If serious infringements occur, lawsuits may be filed.

2) How Can I Simplify The Whole Procedure Of Customs Formalities

Customs Clearance Single Window ‘Al-Nadeeb’

3) What Are The Customs Duty Charges Rates & Procedures In Qatar

Customs Duty Charges

Keep in mind that the merchandise being imported to Qatar will pass through custom duties and would be charged according to the cost of merchandise or the price of each unit alone. All calculations related to the pricing of the merchandise are executed by rules and regulations set forth by the customs and government officials.

- Urea & ammonia 30%

- basic goods 5%

- Steel 20%

Cigarettes and Smoking related products (100% or QR 1,000 /10,000 cigarettes).

Note DocShipper: For more information related to custom duty charges click here

How Can Customers Identify Their Taxes To Pay In Qatar

To find out further details on taxes related to your products, please check the following link: Customs Tariff Qatar

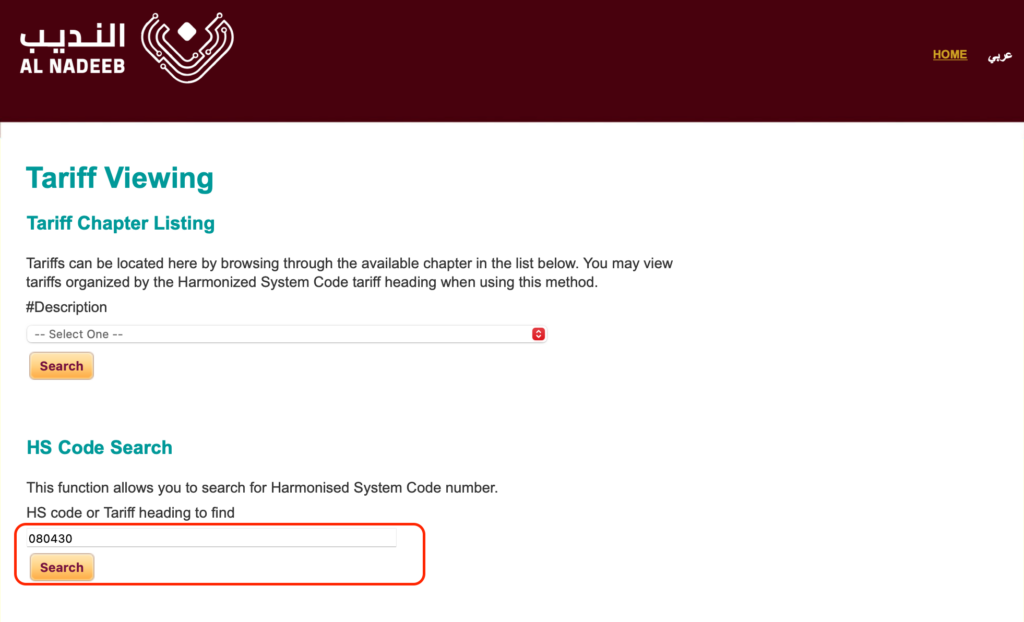

You should reach a page that looks like this :

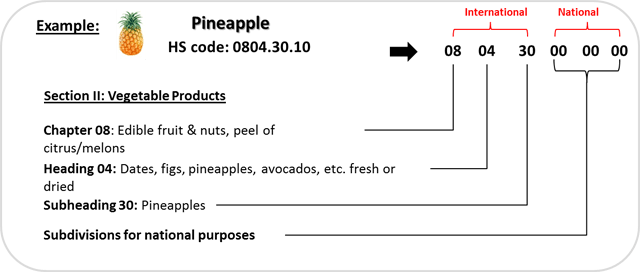

What is an HS code ?

The HS Code will help us determine the taxes. Once you know it, just fill the red frame shown on the picture:

Info DocShipper: If you don’t know your HS code, feel free to ask our experts via WhatsApp. Even better, you can let us handle all the formalities by asking for a free quote. Take care of your product, DocShipper Qatar will handle the rest.

HS Code in Qatar is a common term used often while shipping it stands for (harmonized Commodity description and coding system) or harmonized system HS, these codes are used to classify products according to numerical forms that make it easier for everyone to check all legal issues concerning the categorized items listed on the system to ship.

More than two hundred nations and other major and emerging economies have adopted HS to help gather information for their customs duties, including world trade figures. Over ninety-eight percent of the traded commodities in the world are categorized based on the HS .

The harmonized system helps, and makes it easier for customers undergoing any shipment process in addition to making it easier with the customs duties, as a result, using HS could lead to a lower price while handling shipments.

HS is also used to specify national tax, trading regulations, laws of the country the product is being shipped from, shipping duties delivery price approximate, surveillance merchandise, and so on... that's why the HS is used worldwide by so many people it has become the base of financial data and study on the imported or exported items.

4) In What Way Is The HS Code Structured?

Overview

The HS code is structured based on 10 numerical figures. For the purposes of achieving compatibility, however, contractual entities are required as a minimum to apply 4 or 6 figure units, although they are at liberty to issue further cross-references.

What is the HS code important for?

HS code is important because of its widely used role in many fields such as:

- Custom duties

- Gathering of data on cross-border traffic of goods and services

- Standard Terms and Conditions of the country of origin

- Levying national charges

- Trade talks

- Shipping rates and statistics

- Supervision of monitored merchandise. e.g, garbage, drugs, chemicals,environmental threatening substances, arms...

- Fields of border inspections for customs controls as well as proceedings, such as risk assessment, IT and compliance.

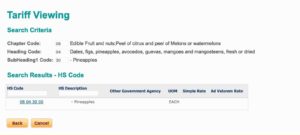

Let’s continue the example with the Pineapple HS Code : 0804 30 00

Now, let’s click on the HS code in blue color. Then you should reach a page which looks like this:

Note: In the agreements tab (as shown above), you can check if there are any agreements made between the country of origin and Qatar.

- That is an important step to avoid misunderstandings on the due date.

5) Exempted & Prohibited Goods

Exempt goods

The exemption classes covers the following areas: private or household material, gift importations, merchandise that are reciprocated, military and diplomatic indemnity. Merchandise that has been cleared in " duty-free zones " as well as tax-free stores are exempt and not subject to any duties. during the transport of goods in process. they can be processed, with no duty paid, at specified locations.

Prohibited goods

It is strictly prohibited to ship flammable substances, explosive materials, drugs, items that originated from countries that have been blacklisted internationally, generally prohibited products or goods violating any trading rule or regulation.

6) Inspection & Legal Proceedings Of Goods

Inspection of goods

The merchandise and its contents may be checked and inspected, normally with while either the buyer or his agent are at the inspection site. Nevertheless, products suspected, banned or wrongly reported could potentially examined without the client being available if they failed to arrive at the agreed time. Rarely, the merchandise might also require a check up prior to informing the customer.

When the check-up is deemed to be legitimate, the expenses of transport to the site of the check-up, and the department specified to repack your goods after inspection are the responsibility of the client. Items which are hazardous, toxic or forbidden can be discarded or exported back to origin.

Legal proceedings

- The Customs agents in Qatar have the authority both to inspect and investigate illegal activities, as well as to conduct an investigation of both the merchandise and individuals allegedly engaged in the trafficking of illegal products.

- Agents are authorized by law the right to enter ships docked at national seaports and to examine all goods transported in the ship.

- Merchandise can be detained in both inland and offshore ports, at customs terminals, airports, marine ports as well as in all locations under Customs control.

- Border officials have the authority to hold in custody on suspicion of illegal trade or hostility during their inspections

DocShipper Advice: Navigating inspections and legal proceedings can be complex. Let DocShipper Qatar handle all the details for you, ensuring your shipments are compliant and secure. Contact us today and ask for a free quote.

DocShipper | Your dedicated freight forwarder in Qatar !

Due to our attractive pricing, many customers trust our services and we thanks them. Stop overpaying the services and save money with our tailored package matching will all type of shipment, from small volume to full container, let us find the best and cost-effective solution.

Communication is important, which is why we strive to discuss in the most suitable way for you!